Most organisations do not pay much attention to business travellers and “accidental expats”.

They believe often their biggest global mobility and cross-border working risks come from expatriates — the employees on formal assignments, with relocation packages, tax support, and structured documentation.

In reality, expats are rarely the problem.

The real risk comes from the people who aren’t classified as expats at all.

The sales manager who spends 40 days a year in Germany. The engineer who flies to France every month. The regional director who “drops in” on teams across Europe. The project manager who works remotely from Spain for a few weeks.

These employees are not tracked, not documented, not assessed for tax or social security exposure, and not supported by global mobility.

They are business travellers — and they are the source of most compliance failures.

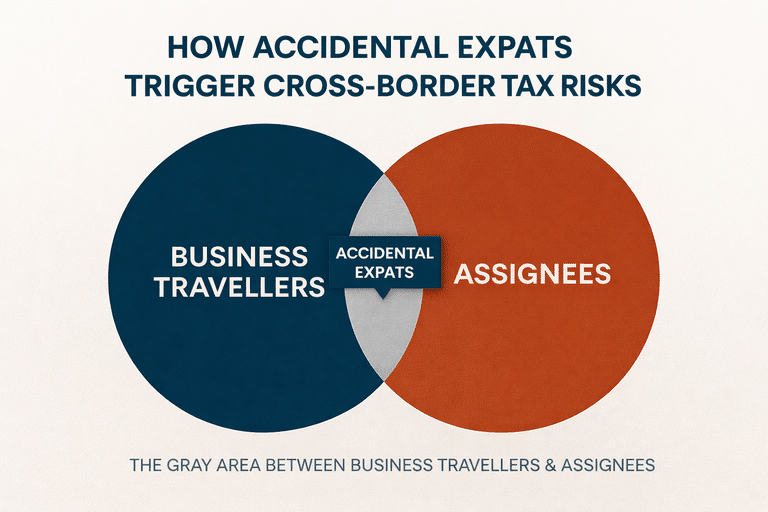

This article explains why the grey area between “business traveller” and “assignee” is where organisations lose control, and what Tax and HR leaders need to understand to fix it.

The Myth: “Business Travellers Do Not Create Risk”

Most organisations operate under a simple assumption:

“If someone is travelling for business a few days here and there, not assigned, they’re low risk.”

This assumption is wrong for three reasons:

1. Tax authorities do NOT care whether employees are classified as business travellers, assignees or accidental expats

They care about:

- where the employee physically works

- who benefits from their work

- who directs and controls them

- who bears the cost

- how many days they spend in the country

Whether HR labels them a “business traveller” or “assignee” is irrelevant.

2. Business travellers often trigger tax obligations long before anyone notices

Many countries require:

- payroll withholding

- corporate tax reporting

- social security contributions

- immigration compliance

- PE risk assessments

…even for short visits.

3. Accidental expats are rarely tracked properly

Most organisations rely on:

- Outlook calendars

- expense reports

- self‑reporting

- travel booking data

None of these are reliable.

This is why business travellers frequently become “accidental expats” (a term not to be confused with “accidental Americans) — employees who trigger tax, social security, or immigration obligations without ever being classified as assignees.

The Accidental Expats Grey Area: When a Business Traveller Quietly Becomes an Assignee

The transition from “business traveller” to “assignee” is rarely formal.

It happens gradually, invisibly, and unintentionally, hence the term “accidental expat“.

Common scenarios include:

- A project overruns and the employee keeps flying back and forth.

- A manager starts spending more time in the host country than the home country.

- A remote worker decides to stay abroad longer than planned.

- A team member supports a foreign subsidiary on a recurring basis.

- A short‑term visit becomes a long‑term pattern.

None of these situations trigger HR processes. None of them involve assignment letters. None of them are reviewed by tax.

But all of them create compliance exposure.

This is the grey area where most failures occur.

Retrospective expat tax residence is the end state of the accidental expat problem.

Why Business Travellers Create More Risk Than Assignees

1. They are not tracked properly

Assignees are tracked. Business travellers are usually not.

This is why organisations often fail to identify short‑term business traveller compliance risks.

Without accurate travel data, you cannot:

- apply treaty rules

- determine tax residence

- assess economic employer

- know if a shadow payroll is needed

- manage social security

- evaluate PE exposure

And yet, most organisations still rely on incomplete or inaccurate data sources.

2. They trigger tax obligations earlier than expected

Many countries tax employment income from day one if:

- the employee is under local supervision

- the host entity benefits from the work

- the host entity bears the cost

- the employee performs revenue‑generating activities

This is why the OECD Commentary on Article 15 emphasises the importance of analysing:

- who directs the employee

- who benefits from their work

- who bears the cost

- the factual working relationship

Business travellers often meet these criteria without anyone realising.

3. Accidental expats and business travellers create shadow payroll obligations

Shadow payroll is not just for long‑term assignments.

It applies when:

- the employee works in the host country

- the host country has taxing rights

- the employer must report income locally

Most organisations only operate shadow payroll for formal assignees, not for business travellers — which is why they often miss when shadow payroll is required.

There are times when a shadow payroll may not even need to be operated and yet, there is still a reporting obligation to inform the local revenues authorities, each year, about the total days short-term business visitors were in the host country for.

4. They trigger social security obligations

Social security is often more complex than tax.

Business travellers may require:

- A1 Certificates

- Certificates of Coverage

- bilateral agreement assessments

And yet, most organisations do not track A1 certificate requirements for short business trips believing (wrongly) that a short business visit does not require an A1 Certificate or Certificate of Coverage to be obtained.

This creates exposure for both employer and employee.

5. They create PE risk

Permanent Establishment (PE) risk is not created by expats — it’s created by employees who:

- negotiate contracts

- manage teams

- make strategic decisions

- perform revenue‑generating activities

- work regularly from the host country

This is why short‑term assignments quietly create PE exposure and why, in the 2025 update to the OECD Model Tax Convention (the template used by countries in the OECD to negotiate, draft and update bilateral tax treaties), new commentaries have been added which provide, inter alia, additional clarity on cross-border working from home (and other places) arrangements within the context of Article 5 which deals with Permanent Establishments.

Business travellers often perform one or more of these PE triggering activities without anyone realising it.

6. They are not covered by assignment letters

Assignment letters are a key control mechanism.

They define:

- payroll mechanisms

- assignment specific benefits

- tax equalisation or tax protection policies

- cost‑bearing entity

- reporting obligations

Business travellers have none of this structure, which is why assignment letters create tax risk when they are missing or inconsistent.

7. They often become tax residents without anyone noticing

Tax residence is triggered by:

- days of presence (bearing in mind that different countries count “a day” in different ways)

- personal and economic ties

- intentions

- centre of vital interests

Business travellers often accumulate days faster than anyone realises, especially when travel patterns shift — something explored in how travel patterns affect tax residence.

The “Accidental Expat” Problem

An accidental expat is an employee who:

- is not classified as an assignee

- is not tracked

- is not supported by global mobility

- is not reviewed by tax

- but triggers tax, social security, or immigration obligations anyway

This is the most dangerous category of employees because:

- no one owns them

- no one monitors them

- no one documents them

- no one budgets for them

- no one informs payroll

- no one informs tax

And yet, they create the majority of compliance failures.

How the Issue Typically Surfaces

1. A tax authority audit

Authorities request:

- travel data

- expense reports

- payroll records

- emails

- calendars

- project documentation

They quickly identify:

- undeclared workdays

- unreported income

- missing shadow payrolls

- incorrect social security contributions

- PE‑triggering activities

This mirrors the patterns described in cross‑border secondment audit triggers.

2. A social security inspection

Authorities ask for:

- A1 Certificates

- Certificates of Coverage

- Contribution records

- Evidence the employee is covered in case of accidents at work in the host country

If the employer cannot produce them, back-dated payments, penalties and interest usually follow.

3. A corporate tax review

Authorities assess whether the employee:

- negotiated contracts

- managed teams

- made strategic decisions

- performed revenue‑generating activities

This creates PE exposure — even when the employee was “just visiting.”

4. An employee dispute

Employees challenge:

- unexpected tax bills

- denied treaty relief

- incorrect payroll withholding

- double taxation (particularly on personal assets which they never thought could be subject to tax in the host country too)

This often happens when employees were never told they were creating tax obligations.

What Tax and HR Leaders Should Do

1. Build a business traveller governance framework

This includes:

- clear definitions

- risk thresholds

- approval processes

- reporting requirements

- escalation paths

2. Implement a real travel tracking system

Not calendars. Not expense reports. Not self‑reporting.

A real system. Ideally one that geolocates and sends updates in real time that both employees and their employer have access to.

3. Create a business traveller risk matrix

This should assess:

- tax

- social security

- immigration

- PE

- corporate tax

4. Integrate business travellers into global mobility

They should not sit outside the process.

5. Educate managers

Managers often create accidental expats without realising it.

6. Review travel patterns annually

Patterns change. Risk changes with them.

Final Thoughts: The Biggest Risk Is the One No One Sees

Most global mobility risk does not come from expats. It comes from the people who fall between the cracks.

Business travellers. Frequent flyers. Regional managers. Remote workers abroad. Project teams on recurring visits.

These employees are not tracked, not documented, and not supported — yet they create the majority of tax, social security, and immigration failures.

Not many organisations spot these classification gaps until it’s too late. Check whether your business travellers might already be functioning as de facto assignees — and quietly creating accidental expat’s cross-border compliance risks.