Join 2,000+ Businesses & Individuals Who Discovered Hidden Compliance Risks

45-second quiz reveals compliance gaps before they become costly problems

✓ 100% confidential

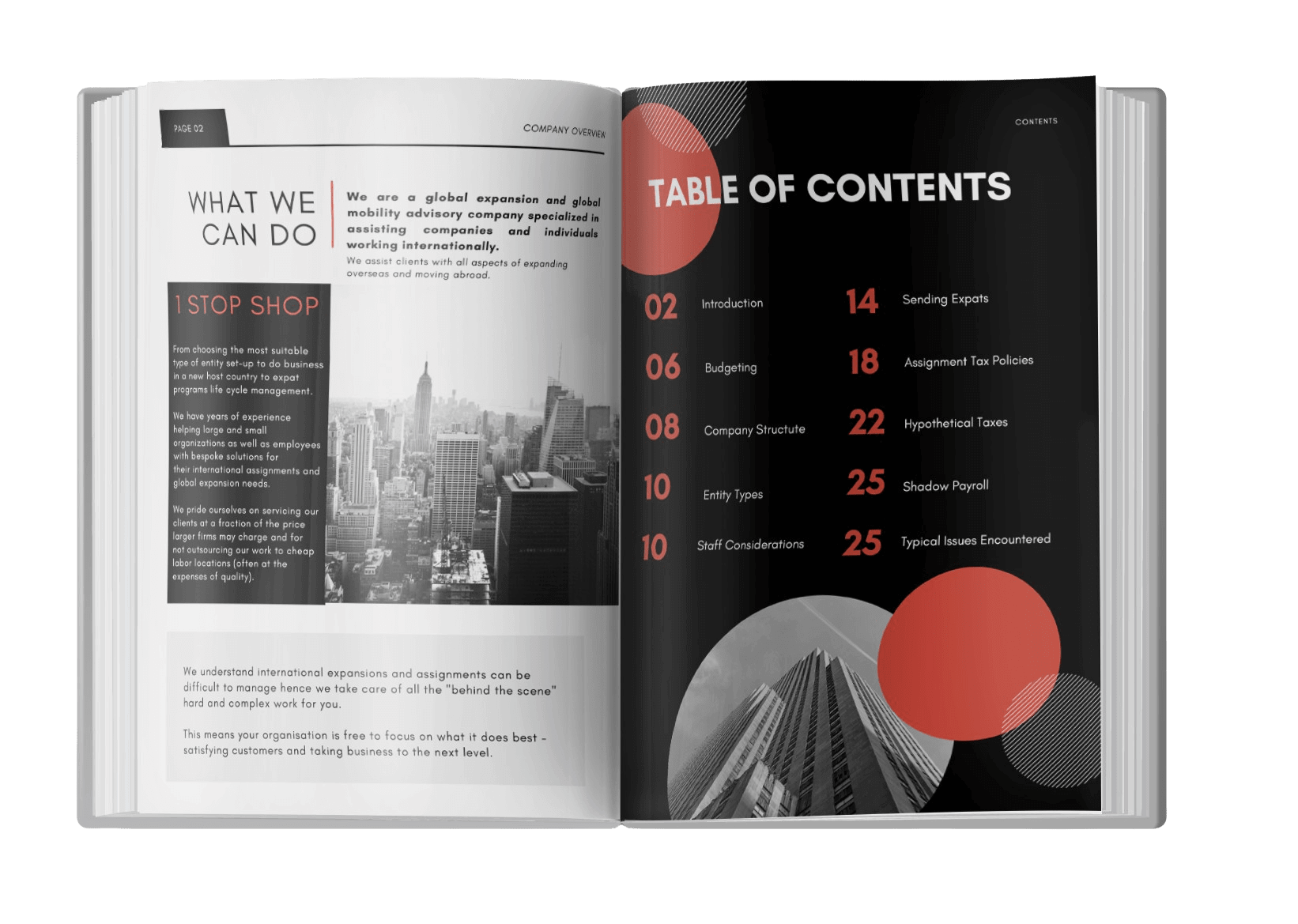

Take the QuizGMTS is a specialist global mobility and international tax consultancy. We provide technical advisory and pragmatic compliance solutions for multinational corporations expanding into new markets, as well as for expatriates and high-net-worth individuals managing multi-jurisdictional cross-border issues.

Our team includes Affiliates of leading professional bodies and holders of highly regarded International Qualifications.

Our approach is grounded in independence, technical excellence and practical execution. By combining specialist expertise with a collaborative mindset, we help organisations and individuals navigate cross-border complexity with confidence.

We bridge the gap between complex local regulations and global commercial strategy, ensuring that our clients remain compliant, risk-averse, and tax-efficient regardless of where they operate.

We currently provide advisory support in the following areas:

Assignment structuring across multiple jurisdictions, including:

Expatriate tax and policy documentation (e.g. T&E policies, assignment letters)

Cost of living differentials analysis

Assignment cost projection and forecasting

(Re)design and (re)implementation of global mobility and expansion policies

Entity set-up and immigration advisory support

We advise on international mobility and global expansion strategies and identify opportunities for tax efficiencies and special tax regimes, including:

The 30% ruling (Netherlands)

Beckham Law (Spain)

Detached Duty Relief (DDR), Statutory Residence Test (SRT) and Foreign Income & Gains (FIG) regimes (UK)

Other country-specific expatriate tax regimes

Supporting clients in minimising total tax and social security costs in a fully compliant manner

At relevant stages of the assignment lifecycle or company secondment programmes, we work closely with third-party service providers selected by our clients, including:

Relocation providers

External tax advisors

Payroll providers in home and host jurisdictions

We also oversee, on behalf of our clients, coordination between HR, Corporate Tax, Corporate Governance and Legal functions, ensuring global mobility matters are managed collaboratively and efficiently.

We assist with a broad range of compliance and operational matters, including:

Tax compliance obligations such as:

Short Term Business Visitors (STBV)

Shadow payroll and Modified PAYE schemes

Fringe benefits reporting

Individual tax returns and tax payments

Social security treaty analysis and implementation of savings opportunities

Payroll consulting, including:

Home and host country payroll requirements

Expense reimbursements

Special wage tax provisions

We support clients in selecting the most appropriate entity structure for their international expansion, such as:

Representative offices

Branches

Non-Resident Payroll (NRP) set-ups

Subsidiaries

Employer of Record (EOR) / Professional Employer Organisation (PEO) solutions

Our advice takes a 360-degree perspective, considering:

Immigration (visa and work permit sponsorship)

Corporate tax implications and Permanent Establishment (PE) risks

HR and employment law considerations

Posted Worker Rules and related regulatory requirements

Tax and social security optimisation strategies

All to provide clients with confidence that no critical issue has been overlooked in their international expansion or mobility arrangements.

Copyright© Global Mobility Tax Services 2026

16 Carlton Drive, London SW15 2BD, UK

The content on this website has been prepared for informational purposes only, and is not intended to provide, nor should you rely on it for, legal, tax, or accounting advice in any jurisdiction. You should consult your own legal, tax, and accounting advisers as part of your international expansion and global mobility plans. Additional details can be found in our compliance statement.

45-second quiz reveals compliance gaps before they become costly problems

✓ 100% confidential

Take the Quiz