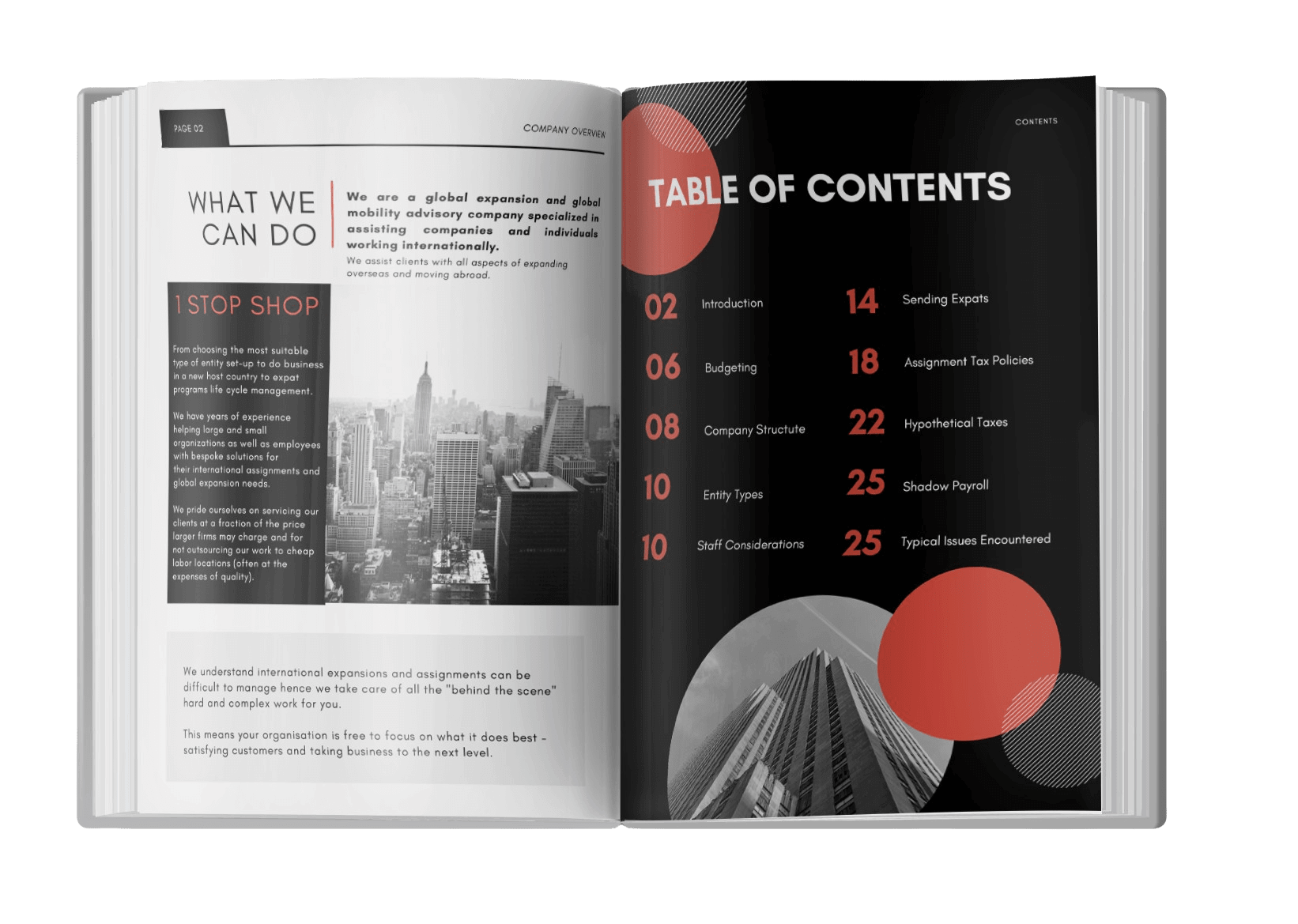

How Assignment Letters Quietly Create Tax Risk for Employers

The Hidden Tax Exposure Sitting Inside Your Assignment Letters Most organisations treat assignment letters as administrative paperwork — something HR drafts, Legal reviews, and employees sign. They’re rarely reviewed by tax, and almost never by someone who understands how tax authorities interpret cross‑border employment arrangements. That’s precisely why assignment letters… Read more about assignment letters and employer tax risk