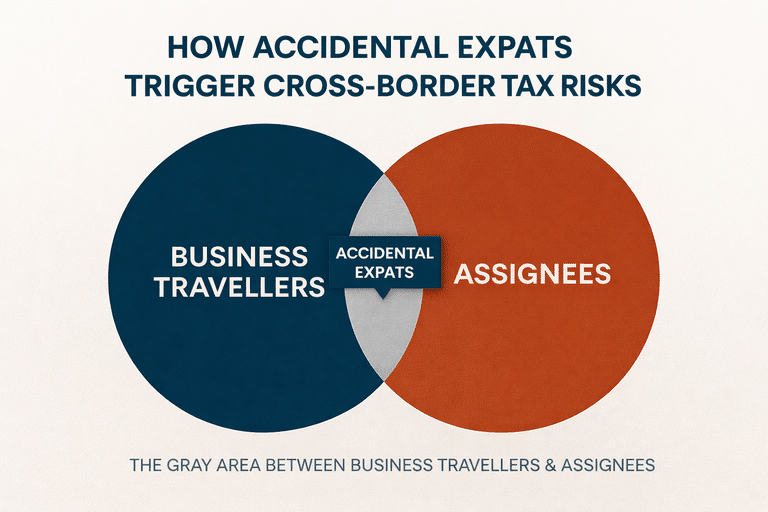

Most organisations do not pay much attention to business travellers and “accidental expats”. They believe often their biggest global mobility and cross-border working risks come from expatriates — the employees on formal assignments, with relocation packages, tax support, and structured documentation. In reality, expats are rarely the problem. The real… Read more about tracking business travellers, assignees and accidental expats